Press Releases

GEP readies stock listing to fund growth

06 June 2020

Solar firm's IPO will enrich capital spending

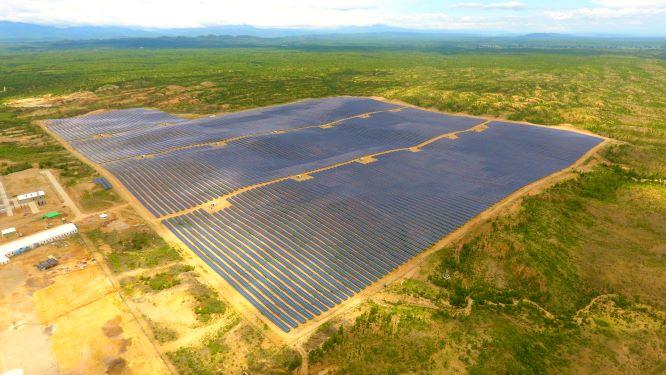

Green Earth Power Thailand Co (GEP), a developer of the largest solar farm in Myanmar, is preparing to list on the Stock Exchange of Thailand to raise funds to expand its solar energy empire.

The company holds a licence for the 220-megawatt Minbu Solar Power Plant project, which spans an area of 2,115 rai in Myanmar's Minbu city.

The plant began generating 50MW since last September, marking the first phase of a four-phase project worth US$247 million.

GEP chief executive Aung Thiha said capital spending for the remaining three phases will come from the initial public offering. The company is asking the Securities and Exchange Commission for permission to list on the SET.

The second phase producing a further 50MW is scheduled for June 2021, while the third and fourth phases -- 50MW and 70MW -- are slated for December the same year.

Electricity generated at the facility is sold to state-run Electric Power Generation Enterprise (EPGE).

The Minbu plant is capable of providing up to 350 million kilowatt-hours per year, enough to power up to 200,000 households.

In the first phase, the solar farms can rack up revenue of $9.7 million, with the amount expected to increase to $44 million when all four phases are operating.

Aung Thiha said the project was given a feed-in tariff for electricity sales of $0.1275 per kWh for 30 years under the build-operate-transfer model.

He said Myanmar can generate a total of 5,642MW of electricity currently, mostly from fossil-fired power plants, but could only supply it to half the population last year.

The government is building new power plants with a combined capacity of 4,940MW, mostly still using fossil fuels.

GEP wants to promote cleaner energy in the country. "We ultimately hope to become a leader in driving the world towards carbon neutrality and creating energy sustainability," Aung Thiha said.

The company, which started in the energy business in 2011, has registered paid-up capital of 215.75 million baht, with a par value of 100 baht per share.

Major shareholders are Scan Inter Plc (SCN) at 40%, Noble Planet Pte (NP) at 28%, East Coast Furnitech Plc (ECF) at 20% and META Corporation Plc at 12%.

Source: www.bangkokpost.com